下载链接/Public/editor/upload/file/20200420/20200420064349_24155.pdf

COVID-19 pandemic impact on Southern Africa

COVID-19 pandemic impact on Southern Africa -Main channels

•

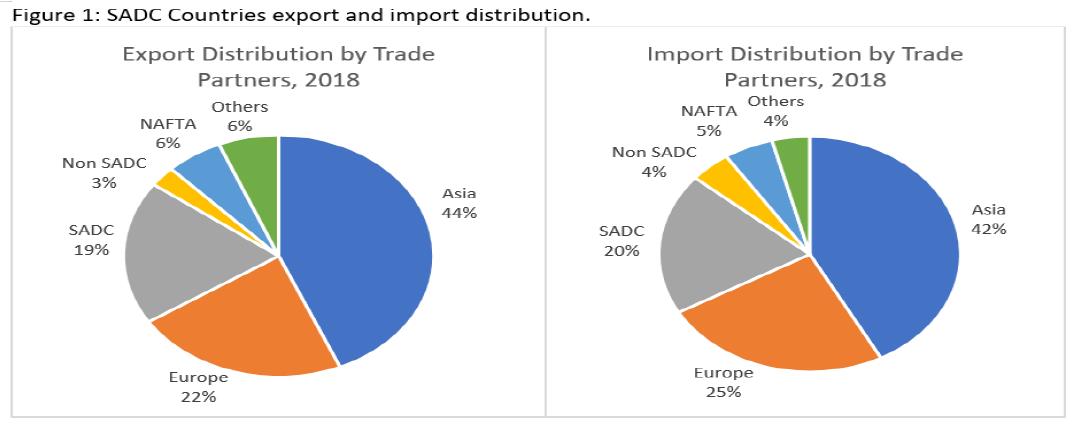

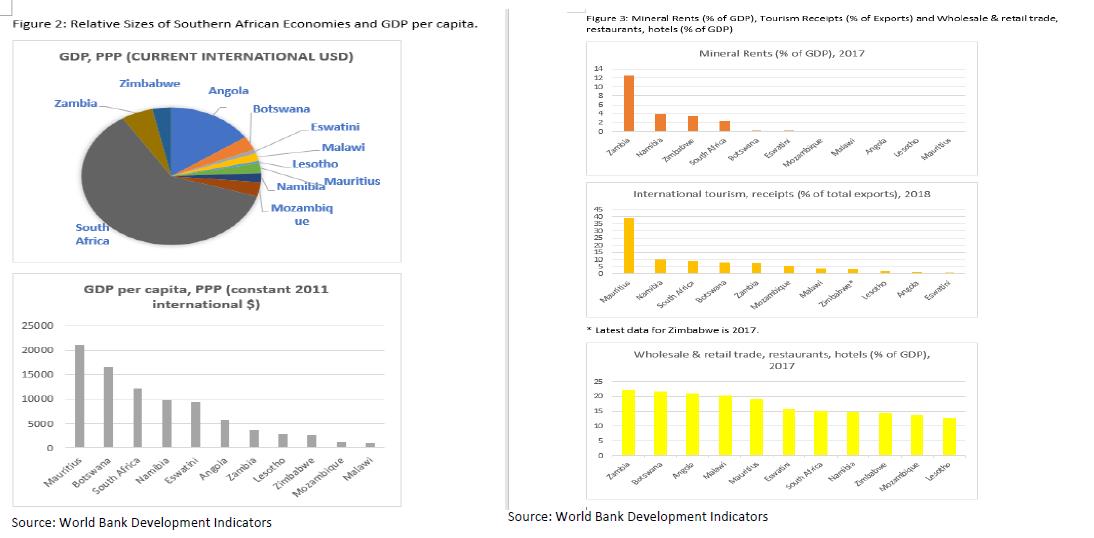

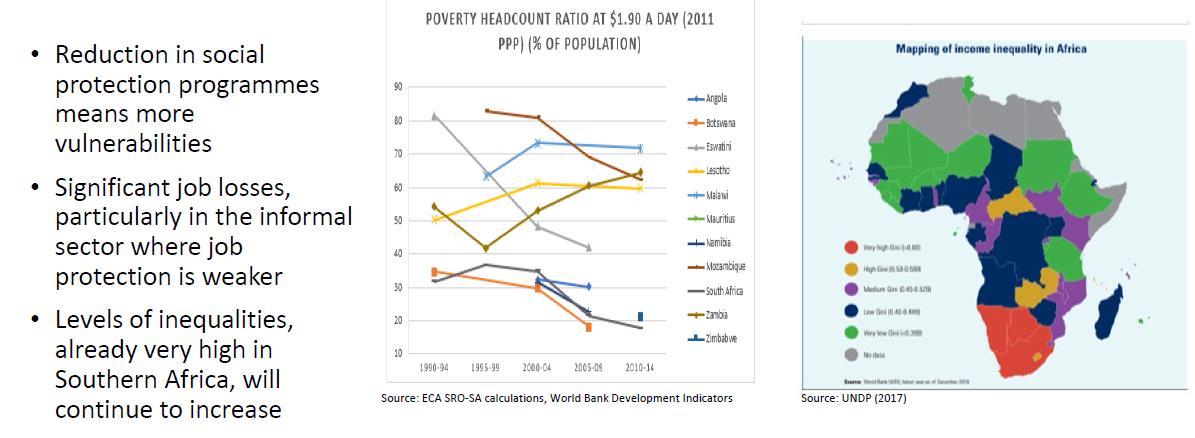

Souther AfricahasadiversesetoftradingpartnersinwhichtheEUandChinaarethemaintradingpartners:SlowergrowthintheseregionscouldreducedemandformanySouthernAfrica'sexportandimportproducts(especially,intermediate).AsthemostindustrializedAfricanregion,SouthernAfricawillbeadverselyimpactedasfactoriesareclosingthroughouttheworldandmanufacturing(e.g.autosector),miningandothercommoditysupplychainsarebeingdisrupted.Businessesinindustriesmostat-riskcouldclosetomitigateinfectionriskforemployeesandcustomersalike.Tourism,transportation,retailandrestaurantsarepossibleexamples.

•

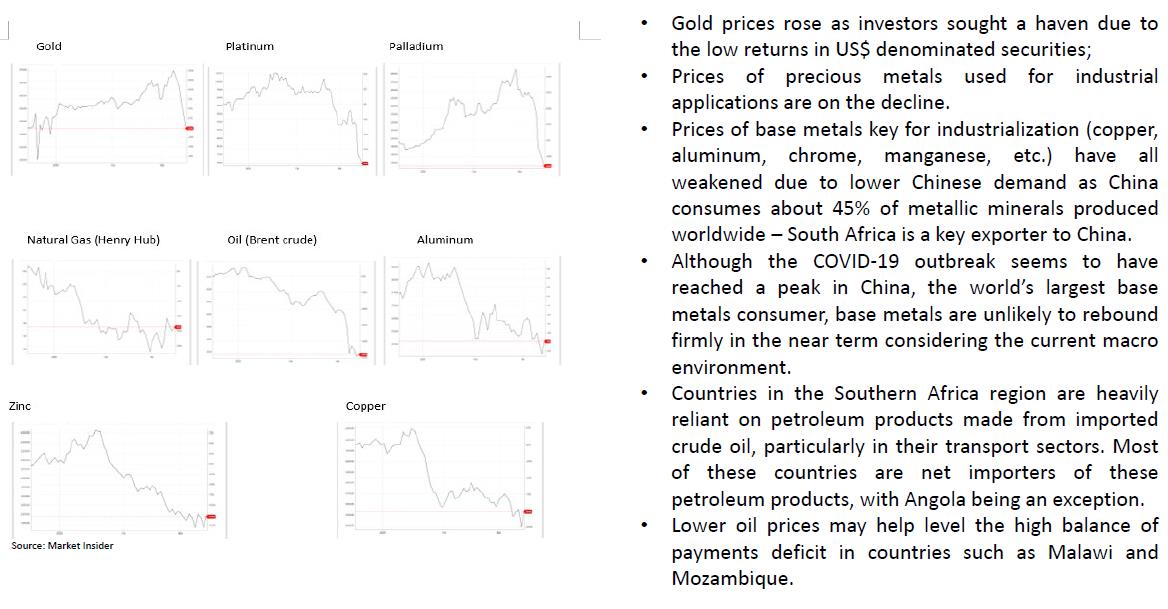

As anexporterofdiversecommodityproducts(e.g.ironore,aluminum,chrome,manganese,copper,gold,diamond,palladium,platinum,coalandoil)countrieswillbeimpacteddifferently.Forinstance,arunforsafecommoditieswillbenefitgoldexportersevenifthemetalmakesatinycontributiontotheoverallGDPs;andthesharpdropinoilwillbenefitmostcountriesbuthurtAngola(with92.4%ofexportearningsfromoilin2018andChinabeingAngola'slargestoilimporter).ForSouthAfrica,Chinaisakeymarketforchrome,iron-ore,manganeseandmetallurgicalcoal.Overall,astheglobaldemandforbothmanufacturedgoodsandmineralresourcesdrops,economiesinSouthernAfricawillsuffer,withlessdiverseeconomies(e.g.ZambiaandBotswana)evenmoreso.

•

As amajortouristdestination(fornature,sport,recreationandconferencing),SouthernAfricaisalreadyfeelingtheimpact,withSeychelles,Mauritius,SouthAfrica,ZambiaandZimbabwerecordingsharpdropsintouristarrivals.PwCestimatesthat1,000tourism-relatedjobsinSAalonearethreatenedinacountrywithalreadycloseto30%unemploymentrate.InLivingstoneandVictoriaFalls,hoteloccupancyratesareaslow30%astouristshavecancelledbookings,short-term/contractstaffhavebeenlaid-off.

•

In recentyearsSouthernAfricahasattractedmostFDIsinthecontinent,butgloballyUNCTADexpectstheseinflowstofallby5-15%.InSouthAfricathebusinessconfidenceinallkeysectors(manufacturers,buildingcontractors,retailers,wholesalersandnewvehicledealers)hasgonebelow50–i.e.negative–indicatingthatbusinessconditionsaredeemedunsatisfactory.

•

The Randhasweakenedby11%inthefirst2monthsof2020,draggingdownotherSACUmembers’currencies;andtheratingcreditagencyMoody’sisexpectedtodowngradethecountrytoanon-investmentgradelaterinMarch2020.Thecountryhadalreadyslippedintorecessioninlate2019.

•

Countercyclical policiesarehamperedbyoveralllowgrowth(theregionisgrowingtheslowestofallAfricanregions)andhighlevelsofpublicdebt.Whilecentralbanksareexpectedtosoftenthepandemicblow,monetarypolicyalonewillbeineffectiveinencouragingeconomicactivityinthefaceoflimitedfiscalpolicycapacity.Also,countercyclicalpolicieshavelimitedabilitytomitigatesupplysideimpacts;forexampletheycannotmakeupfortheabsentworkersdraggingontheeconomy’sproductivecapacity.

As COVID-19 has now spread throughout the world, South Africa, as Chair of the AU, should lead the continent in encouraging deeper intra-African trade and investment as a bulwark against external shocks to the continental economy and progress towards SDG attainment.

COVID-19 outbreak expected impact via commodity demand and prices

COVID-19 outbreak expected impact via travel restrictions and border closures

Serious challenge to SDGs’ achievement as we are entering the decade of action

Policy measures

中非桥官方微信

中非桥官方微信